09 December 2024

Military UAS Sector Study RELEASED

The content presented below is taken form Teal Group's

2024/2025 World Military Unmanned Aerial Systems Market Profile & Forecast

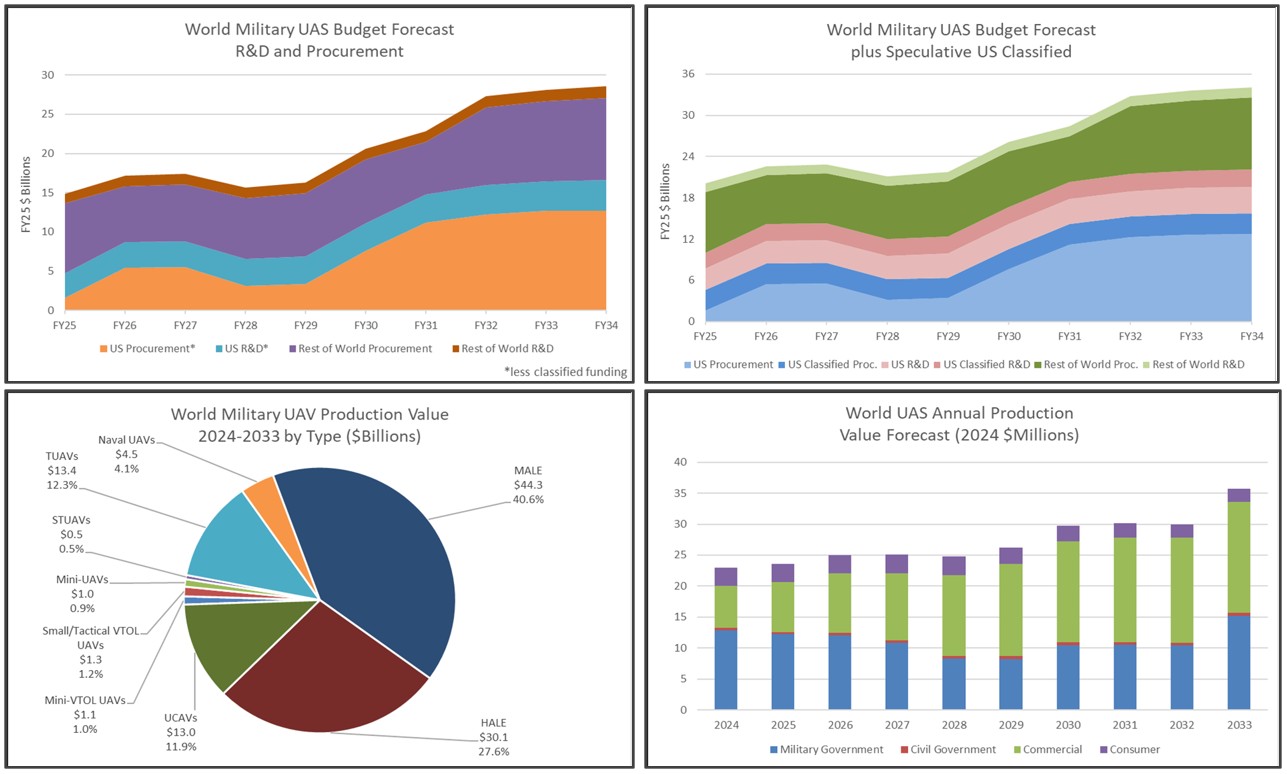

In terms of worldwide military budgets, the unmanned aircraft systems (UAS) segment continues to see growth, although annual growth has moderated when compared to a decade ago. The unclassified sector will continue to increase over the next decade, by about 91.9%, almost doubling, from current annual spending on RDT&E and procurement of about $14.9 billion in FY25 to about $28.6 billion in FY34 (a CAGR of 7.5%). If operations and maintenance expenditures were to be added, these totals would be greater.

This growth is being driven by the continued adoption of unmanned aerial systems (UAVs) worldwide. Over the next decade, unclassified US procurement will grow modestly, until FY30 when potential Collaborative Combat Aircraft (CCA) procurement could substantially boost the topline. Another big issue for the US drone sector is the extent of secret “black” drone programs.

CCA aside, growth will increasingly shift towards international markets as more militaries adopt the lessons of Iraq, Afghanistan, Syria, Libya, Nagorno-Karabakh, and Ukraine and incorporate UAVs into their forces. The introduction of specially built unmanned combat air vehicles (UCAVs) also promises to drive growth over the next decade.

The most significant catalyst to this market has been the enormous growth of interest in UAVs by the US military, tied to operations in Iraq and Afghanistan, as well as the general trend towards information warfare and netcentric systems. UAVs are a key element in the intelligence, surveillance, and reconnaissance (ISR) portion of this revolution, and they are expanding into other missions as well with the advent of hunter-killer UAVs. The reason for the slow-down in US growth has been the decline of US unclassified procurement over the past decade with the end of the wars in Iraq and Afghanistan. The US military currently has the world’s largest and most sophisticated drone fleet, with the rest of the world only beginning to catch up. Although Ukraine and Russia are now sometimes described as having larger drone arsenals, this is a misconception since much of this force consists of short-lived, expendable “kamikaze drone” that are in fact missiles/loitering munitions.

Our research finds that the US will account for 71.7% of the unclassified R&D spending on UAV technology over the next decade, and about 47.2% of the unclassified procurement through the forecast decade. These US UAV funding shares for R&D and procurement represent slightly smaller shares of the market compared to defense spending in general. The US accounts for about 75% of total overall worldwide defense R&D spending and 35% of defense procurement spending, according to Teal Group’s International Defense Briefing forecasts.

The military UAS percentages change significantly when adjustments are made for US classified UAV development and procurement funding. The value of these “black” programs can only be surmised. With these assumptions, the US accounts for 81.2% of the world R&D on UAVs and 55.6% of the procurement.

This difference is due to the heavier US investment in cutting-edge technologies and the marked lag-time in such research and procurement elsewhere, especially major aerospace centers such as Europe. This follows trends in other cutting-edge technologies observed over the past decade by Teal Group analysts in such areas as precision-guided weapons, information and sensor technology, and military application of space systems.

A tangible example of the “black” UAV budget in the US is the RQ-170 Sentinel program which only came to light when one of the stealth drones came down in Iranian territory. Recent revelations about the RQ-180 provide another example.

Teal Group expects that the sales of UAVs will follow recent patterns of high-tech arms procurement worldwide, with Europe representing the second largest market, followed by the Asia-Pacific region. Indeed, the Asia-Pacific region may represent an even larger segment of the market, but several significant players in the region, namely Japan and China are not especially transparent about their plans compared to Europe. As in the case of many cutting-edge aerospace products, Africa and Latin America are expected to be very modest markets for UAVs.

World Military Unmanned Aerial Systems Market Profile & Forecast is an annual sector study that allows clients to identify lucrative potential business opportunities in the increasingly dynamic international military UAS market. It contains a wealth of timely intelligence and analysis on the systems, as well as requirements on a country-by-country basis.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591