10 December 2024

General Dynamics UPDATE -- Top Line Grows, Profit Flat

The content presented below is taken from Teal Group's

Defense and Aerospace Company Briefing

General Dynamics is a global aerospace and defense company that specializes in high-end design, engineering and manufacturing to deliver state-of-the-art solutions to its customers. The company offers a broad portfolio of products and services in business aviation; ship construction and repair; land combat vehicles, weapons systems and munitions; and technology products and services.

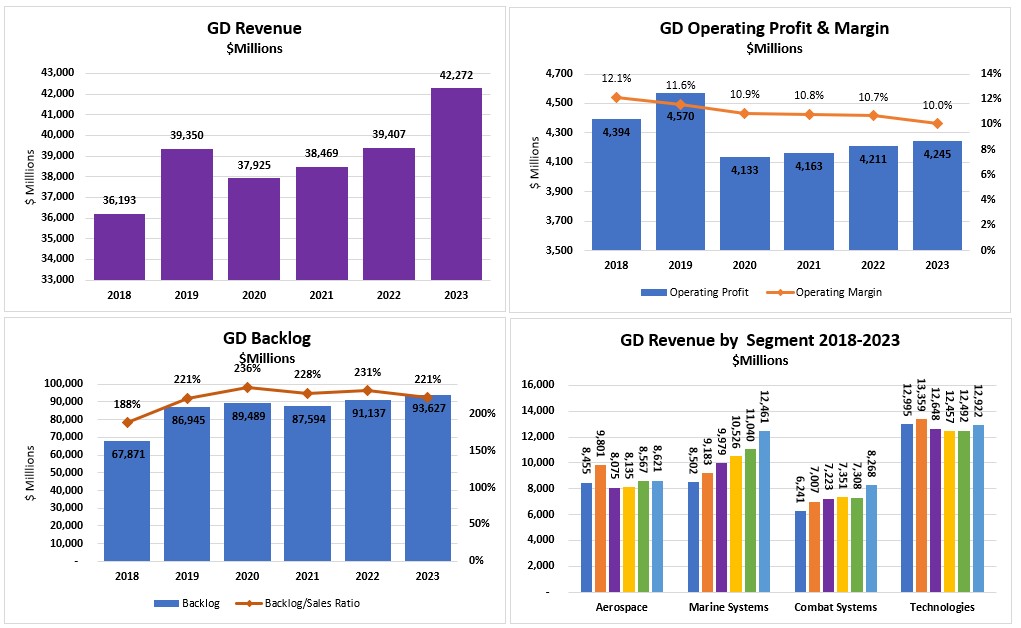

Total company revenue was $42.34 billion in 2023, up 7.3% from $39.4 billion in 2022 which was up 2.4% from 2021. Compared to other defense and aerospace companies, General Dynamics had a relatively modest negative impact on its financial performance due to the global pandemic. Total operating profit was $4.272 billion in 2023, up 0.8% from $4.211 billion in 2022 and still down sharply from the $4.57 billion achieved in 2019. The company’s operating margin has steadily declined from a high of 13.5% in 2017 to 10% in 2023. Long-term debt did rise sharply following the acquisition of CSRA in 2018, increasing to $11.4 billion in that year versus only $4 billion in 2017. Except for an increase during the height of the pandemic, management has reduced long-term debt to $8.8 billion by the end of 2023.

The company consists of 10 business units, which are organized into four operating segments: Aerospace, Combat Systems, Marine Systems and Technologies.

The Technologies segment is organized into two business units — Information Technology (IT) and Mission Systems. IT modernizes large-scale IT enterprises and deploys the latest technologies to optimize and protect customer networks, data and information. Mission Systems offers solutions across multiple domains and produces a unique combination of products and capabilities that are built for essential C5ISR applications.By the end of 2023, the company’s total Technologies segment accounted for $12.922 billion of revenues. Combining $8.459 billion from information technology services and $4.463 billion from C5IS solutions.

By the end of 2023, the company’s Marine Systems segment accounted for $12.461 billion of revenues. Combining $8.631 billion from nuclear powered submarines, $2.698 billion from surface ships and $1.132 billion from repair services and other. The Marine Systems segment is a leading designer and builder of nuclear-powered submarines and a leader in surface combatants and auxiliary ship design and construction for the U.S. Navy. It consists of three business units: Electric Boat, Bath Iron Works and NASSCO.

Combat Systems segment is a manufacturer and integrator of land combat solutions worldwide, including wheeled and tracked combat vehicles, weapons systems and munitions. The segment consists of three business units: Land Systems, European Land Systems (ELS), and Ordnance and Tactical Systems (OTS). By the end of 2023, the company’s Combat Systems segment accounted for $8.268 billion in revenues. Combining $5.036 billion from military vehicles, $2.442 billion from weapons systems, armaments and munitions and $790 million from engineering and other services.

The Aerospace segment consists of the Gulfstream and Jet Aviation business units. General Dynamics designs, manufactures and services an advanced line of business jets. By the end of 2023, the company’s Aerospace segment accounted for $8.621 billion of revenues. Combining $5.710 billion from aircraft manufacturing and $2.911 billion from aircraft services and completions. While manufacturing has been soft for the last three years, services have grown at or just below double-digit annual rates.

The Defense & Aerospace Companies Briefing includes coverage of major global competitors. Each report addresses key events, strategic initiatives, segment performance, product development, contracts, partnerships, acquisitions, restructurings, finances and more.

To inquire about subscribing, visit Defense & Aerospace Company Briefing

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591