20 December 2021

Northrop Grumman Corp.

Northrop Grumman Corp. is well aligned with the national security strategy. The company’s strengths in strategic bombers, ICBMs, and unmanned aerial vehicles are critical capabilities as the US military focuses more on possible confrontation with major powers including China and Russia.

The company generally is focused on strong defense budgetary growth areas for the future military: intelligence, surveillance, reconnaissance, unmanned aerial vehicles, strategic bombers, and electronic warfare. Even within the growth niches it has chosen, Northrop Grumman is working to get into the highest growth portions of the business. The company also has a very diversified portfolio within the defense sector, adding stability for the future.

Northrop Grumman is positioned in the strong spending areas such as command, control, communications, computers, intelligence, surveillance, and reconnaissance. Better integration of the various businesses acquired in recent years promises to increase the number and size of programs that Northrop Grumman can pursue. The acquisition of Orbital ATK has further improved the company's positioning in growth areas such as space and ballistic missile defense.

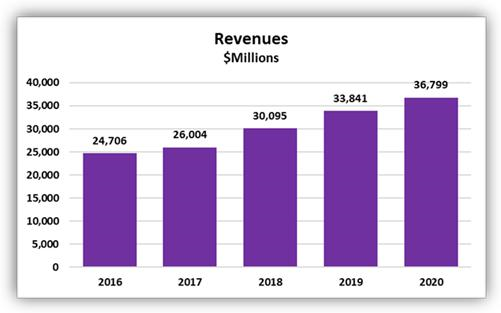

The company had total revenue of $36.8 billion in calendar year 2020, a nearly 9% increase from the previous year. Over the past five years it has grown by 50%, starting in 2016 at $24.7 billion. Over this same period, its Operating Margins declined from 13.3% in 2016 to 11% in 2020. So, while top line growth has been robust, profitability has lagged. While some of this can be attributed to the COVID pandemic, the decline has been fairly consistent over the five years.

Aeronautics Systems is the largest of the four business units. It finished 2020 with total revenue of $12.2 billion, up nearly 10% from 2019. Mission Systems is next at $10.1 billion in 2020, up 7.1% year on year. In third place is Space Systems with same year revenue of $8.7, up nearly 18% from 2019. Defense Systems with $7.5 billion in 2020 revenue was up less than 1% from the previous year.

The backlog stood at $81 billion at the end of 2020, more than 2x annual revenue. Space systems had a 4x backlog, followed by Aeronautics Systems 2x, Mission Systems 1.4x and Defense Systems 1.1x.

As of late October 2021, management estimated that full-year 2021 revenues would be approximately $36 billion, down somewhat from 2020. For the first nine months of 2021, the company had revenues of $27 billion, which was up slightly over the same period in 2020.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591