12 December 2024

Lockheed Martin UPDATE -- Top Line Flat, Profit Margin Drifting Lower

The content presented below is taken from Teal Group's

Defense and Aerospace Company Briefing

Lockheed Martin is the world’s largest defense contractor. With a strong presence across multiple key aerospace segments, the company is well positioned to compete for critical US and international opportunities. Its expertise in systems integration, space and aircraft also gives it considerable potential to bring together the systems capabilities to which major US prime contractors now aspire. In addition, Lockheed Martin has a long lived and a strong reputation for technological expertise.

Lockheed Martin has an unrivaled position in combat aircraft, providing the potential to dominate future worldwide fighter production. As the prime contractor for the F-16 fighter, the F-22 fighter and the F-35 Joint Strike Fighter Lockheed Martin has the premier portfolio of fighter programs. The strength of the F-35 insures this position for the foreseeable future.

Lockheed Martin also is the preeminent US company in developing hypersonic missiles and other weapons. It has won key contract in the area which will be richly funded in coming years to prevent the US from falling behind Russia and China. Key programs include MLRS, THAAD, PAC-3 and JASSM.

With F-35 looking to be growth constrained, Lockheed needs to win new opportunities that yield substantial revenue. Its recent selection by the U.S. Missile Defense Agency to provide the Next Generation Interceptor, worth at least $17 billion in revenue, is a major win that should yield long-term production potential.

Major acquisitions have been elusive. Aerojet Rocketdyne (AJRD) was the latest acquisition target, with a planned closing to take place in late 2021. Lockheed already had access to key elements of Aerojet’s technology. However, the acquisition was intended to allow for faster, more efficient integration of the propulsion systems that Aerojet makes for potential use with the missiles, hypersonic weapons and space systems developed by Lockheed.

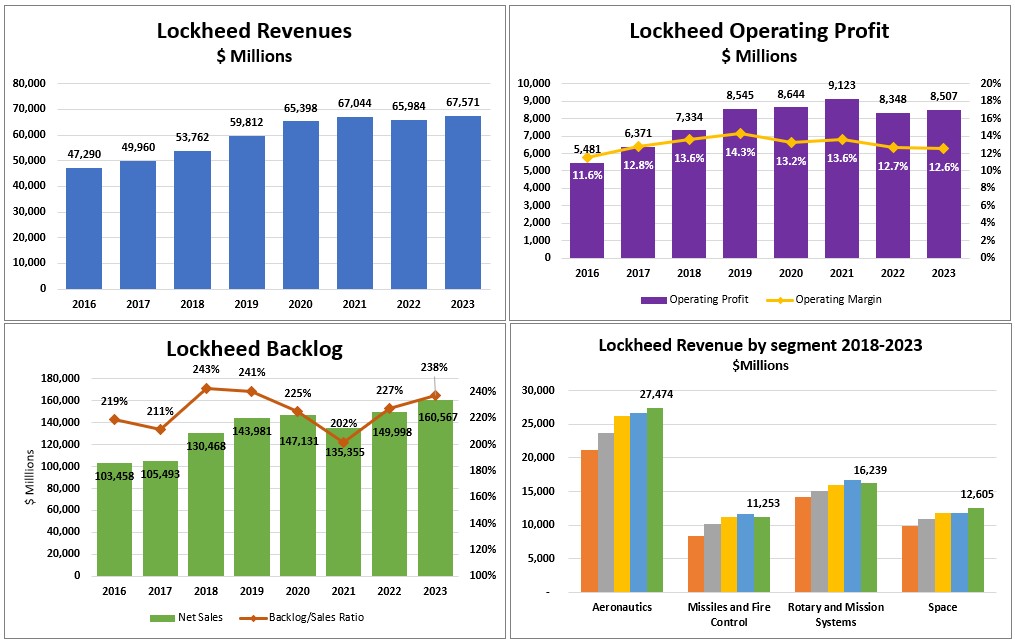

For the full year of 2023 total revenue was $67.571 billion, up 2.4% from 2022 when its revenue of $65.984 was down 1.6% from 2021. The company’s operating profit has been relatively flat for the last two years. Operating profit was $8.507 billion in 2023, up 1.9% from 2022’s $8.348 billion, which was down 8.5% from 2021.

At the end of 2023, Lockheed’s long-term debt was $17.3 billion, dramatically up from the previous year when it was $ 15.4 billion and $11.670 billion in 2021. Prior to this, management had done a good job of reducing debt over the previous six years from a level of $14.2 billion at the end of 2016.

Outlook for 2024. Through the end of the 2nd Quarter of 2024, Lockheed saw its top line revenue improve by 11% from the same six-month period in 2023: $35.317 billion in 2024 vs. $31.819 billion in 2023. The increase was felt across all four segments. Aeronautics was up 7.4%, and Space up by 5.5%. The strongest growth was in Missiles and Fire Control which was up 18.5% and Rotary and Mission Systems which was up 16.6%.

The Defense & Aerospace Companies Briefing includes coverage of major global competitors. Each report addresses key events, strategic initiatives, segment performance, product development, contracts, partnerships, acquisitions, restructurings, finances and more.

To inquire about subscribing, visit Defense & Aerospace Company Briefing

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591