18 February 2025

Latent demand will keep airplanes full and airlines profitable. Cyclic downturn starting around 2030.

This is the time we cycle over our forecasts for the next 10 years, thus our 10-year forecast now covers the years 2025-2034.

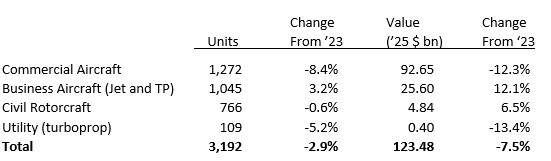

But first, let’s review last year. As you may recall, we expected 2024 to be a banner year, with units rising almost 8% and values 11%. Unfortunately, what with the aftermath of the Alaska Airlines MAX 9 incident, ongoing regulatory and supplier delays, and labor actions, things didn’t quite pan out as planned. While Boeing was hit by the perfect storm of all of these, every manufacturer was affected one way or another by some of these mitigating factors. By our reckoning (not all the numbers are in yet) we can summarize the year in this table (note that our dollar figures are based on 2025 dollars):

Boeing’s horrendous numbers mask a not so bad year for most of the other manufacturers, year on year. While the Commercial Aircraft figures in aggregate took a step back to nearly the same point as in 2022, Airbus surged ahead with over 60% of deliveries while Boeing’s share slumped to just over 27% from 38% in the previous two years. Business Aircraft and Utility would have had a better year but for the strike at Textron, while the deliveries of new large cabin business jets were responsible for outsized revenue gains.

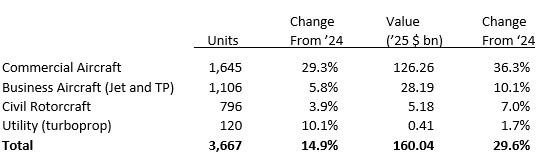

Having said last January that 2024 promised to be quite a bit better than 2023 – and having been roundly contradicted – we cautiously suggest that, barring any unforeseen events, we should see an improvement in 2025 over 2024. Based on what we know today, this is what we see for 2025:

Note the strong value growth this year relative to units. Basically, what we are seeing is deliveries of higher value single-aisles (especially the A321neo) and more large cabin business jets. Additionally, it seems that twin-aisles were especially hobbled by supply chain issues in 2024, from which we expect some recovery in 2025.

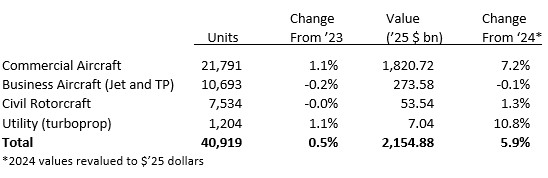

Which brings us to our full 10-year forecast for 2025-2034. The table below gives the totals for our current forecast and how that compares with the 2024-2033 forecast we posted in December of last year:

As can be seen, in this year’s forecast, volumes are slightly higher and total values are much higher than last year’s, reflecting a general increase in unit size and value. What these total number do not show, however, is our expectation of a cyclic downturn starting around 2030. Our base case suggests steady delivery growth through about 2030, followed by delivery declines in the back end of our forecast with a modest recovery in 2034. The other dynamic that we have adjusted in our forecast is the return of twin-aisle aircraft. The underlying rationale for this is that average seat size continues to increase and even the A321neo will begin to be too small for certain operations, most notably at congested airports. Additionally, passenger trips are getting longer, suggesting a need for aircraft that can fly farther than the longest range single aisle can. One result we see is that the market for the smallest aircraft continues to stagnate to the point where we can expect the A320 and 737 MAX 8 to become de facto regional aircraft. Subscribers can access all the detail behind these numbers through the Teal Group web site.

The first few weeks of the new Presidential administration has ratcheted up uncertainty for the industry. From tariffs and personnel changes, it’s possible that we’ll experience disruptions as benign as certification delays or as serious and cancelled orders. Or, it could go the other way, with streamlined certifications and new negotiated trade agreements that smooth the path for better trade relations with friends and foes alike. Or something in between. At this juncture it is too early to say, so we will be watching how things develop and, as we usually do, make adjustment to our near-term forecasts as they seem warranted.

Still, in the near term at least, we maintain our belief that trends are more positive than negative for 2025. For one, travel demand still is not at the level it should be had it not been disrupted by the Covid-19 pandemic. This suggests sufficient latent demand that will keep airplanes full and airlines profitable for the next few years, so prospects for 2026 and 2027 are looking good as well.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591