06 May 2025

L3Harris UPDATE Focus shifts from acquisitions to growth

The content presented below is taken from Teal Group's

Defense and Aerospace Company Briefing

Expansion through acquisition and merger has been the focus of management over the past several years. The most recent acquisition of Aerojet Rocketdyne in mid-2023 was preceded by the acquisition of Tactical Data Links in early-2023 and the merger between Harris and L3 in 2019.The increased scale of L3Harris will make it a stronger competitor to defense prime contractors.

At the time of the acquisition of Aerojet Rocketdyne, L3Harris management stated: “The acquisition diversifies the L3Harris portfolio, adding considerable long-cycle backlog and broad expertise that enables opportunities in missile defense systems, hypersonics and advanced rocket engines, among other areas.” With the addition of Aerojet’s more than $2 billion annual revenue, the company anticipated a significant boost to its overall market position. Early evidence with various recent contract awards provides some confirmation of this objective, while revenue growth has been modest to date.

As the largest US propulsion enterprise, Aerojet Rocketdyne provides critical mass in propulsion. Aerojet covers all five propulsion categories: liquid, solid, air-breathing, electric, and hypersonic. Aerojet Rocketdyne is the only US company offering both solid and liquid propulsion systems. In recent years, it has established leadership in tactical missile propulsion systems and space propulsion in the

United States, such as that used for satellites and manned or unmanned spaceships. With Rocketdyne as part of the company, the position in liquid propulsion systems, an area that Rocketdyne dominated, has been strengthened dramatically.

It remains too early to get a strong understanding of how company financial performance is evolving following the merger and most recent acquisitions. A number of factors make the assessment challenging: divestiture of certain business units, integration and streamlining efforts, COVID impacts and longer-term supply chain disruptions as COVID recedes.

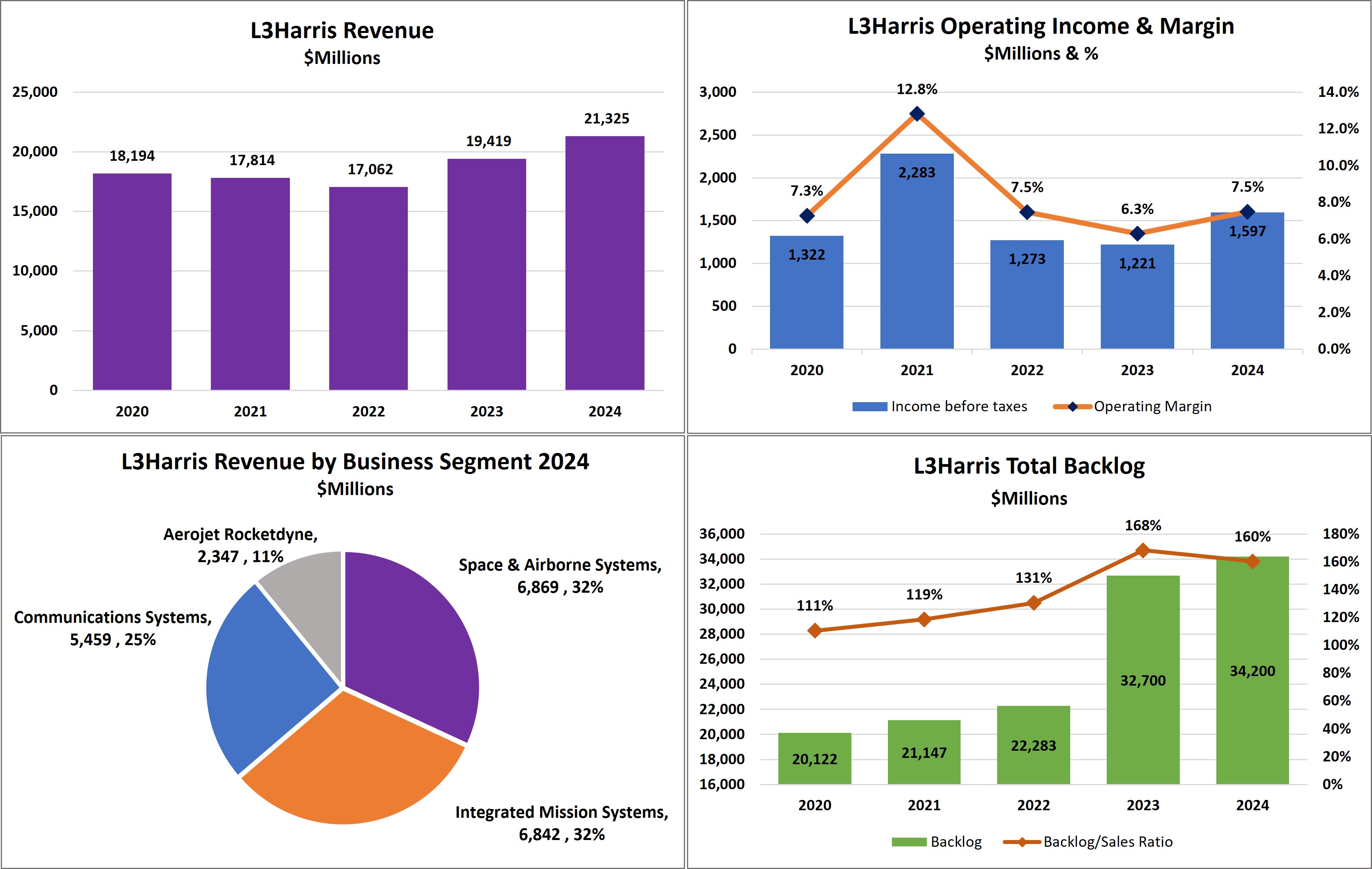

Total revenues finished calendar 2024 (the company’s fiscal year) at $21.3 billion, a 9.8% increase over the 2023 figure of $19.4 billion. Income before taxes was $1.60 billion in 2024, up 31% from $1.22 billion in 2023. Operating Margin was up from 6.3% to 7.5%.

The backlog was $34.2 billion at year-end 2024, vs. $32.7 billion the previous year. In comparison to other large US defense companies, the ratio of backlog to sales of 160% is on the low side.

Business segment revenues for 2024 were as follows: Integrated Mission Systems, $6.8billion (32% of total company revenue), Space & Airborne Systems $6.9 billion (32%), and Communications Systems $5.5 billion (25%) and Aeroject Rocketdyne $2.3 billion (11%). Aerojet’s 2024 account for the full year, whereas its 2023 revenues represented only a part of the year.

In 2024, the US Government accounted for 76% of all sales. Geographically, US customers represented 80% of sales and international customers the remaining 20%.

The Defense & Aerospace Companies Briefing includes coverage of major global competitors. Each report addresses key events, strategic initiatives, segment performance, product development, contracts, partnerships, acquisitions, restructurings, finances and more.

To inquire about subscribing, visit Defense & Aerospace Company Briefing

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591