26 February 2025

he FAA incremental approach to opening the U.S. airspace to civil and commercial drone use is gaining momentum

The content presented below is taken form Teal Group's

2024/2025 World Civil Unmanned Aerial Systems Market Profile & Forecast

The US Federal Aviation Administration has been working to speed up the opening of US airspace for routine operations since at least 2009. Despite this, serious challenges remain, but 2024 saw significant acceleration.

FAA’s long-term integration strategy seeks to gradually introduce low-risk, isolated work, then move to full integration of UAS into national airspace.

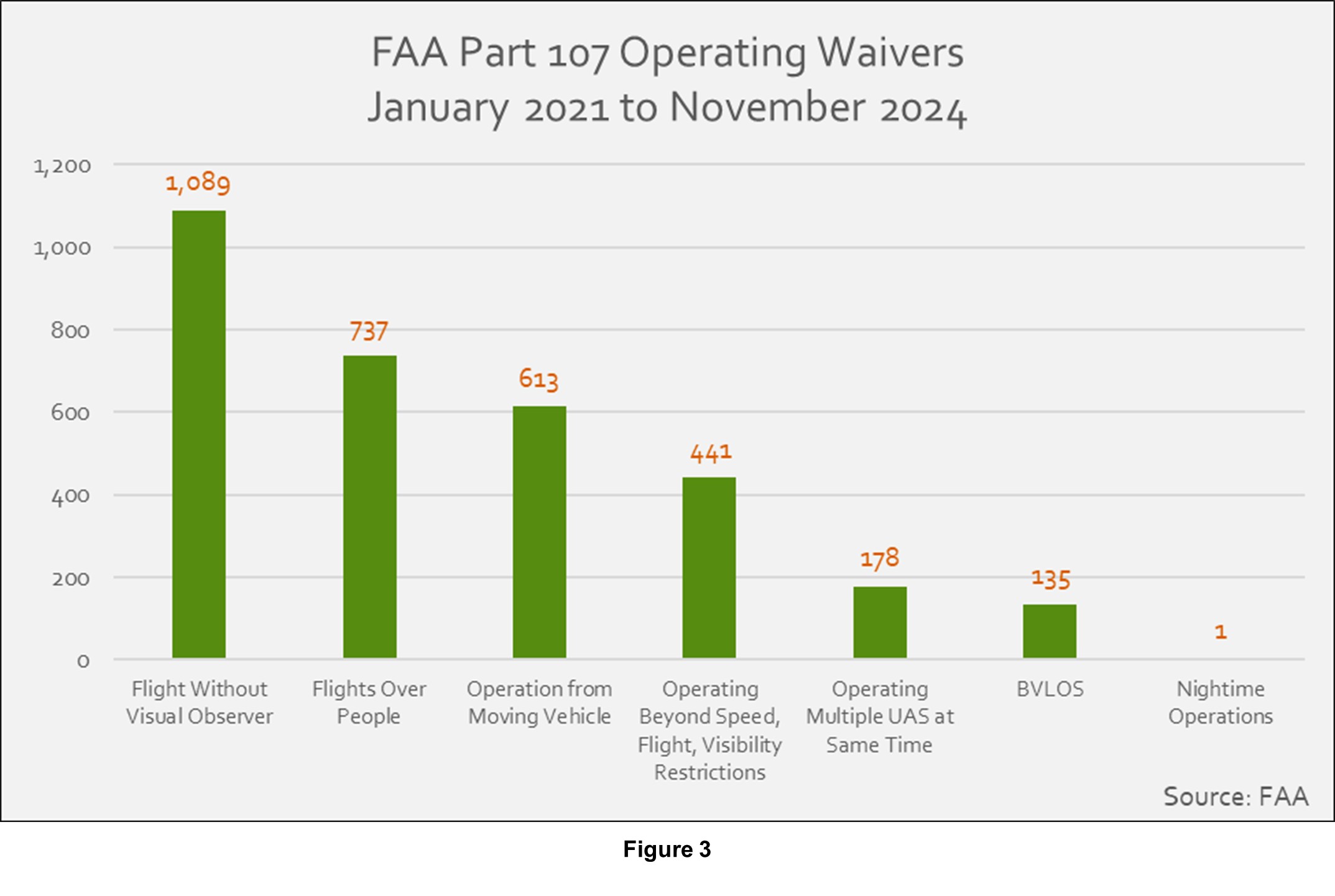

To be sure, the FAA has made significant strides to resolve several outstanding issues. A new rule allowing flight over people and night flights in certain circumstances was published in April 2021. The FAA also introduced a Remote ID system in December 2020 to allow identification of UAS, easing concerns about misuse of drones as they begin flying over people. And in the biggest step,

the agency is releasing a formal Notice of Proposed Rulemaking for BVLOS flights. It is projected to take effect in 2026 as Part 108.

Those proposed rules build on several experiments. In 2022, the FAA granted Percepto, an autonomous inspection and monitoring solution provider, a national waiver for BVLOS operations, if client sites met certain criteria. Phoenix Air Unmanned was approved in August 2023 to operate SwissDrones SDO 50 V2 helicopters BVLOS for aerial survey and power line and pipeline inspection. The next month saw the FAA approve BVLOS deliveries by UPS drones in at least three U.S. states. This, coupled with approvals of the first small drones to receive a Part 21.17(b) type certification from the FAA, Matternet’s M2 and Airobotics’ Optimus-1EX, heralds a significant evolution toward a modern US drone market.

World Civil Unmanned Aerial Systems Market Profile & Forecast is an annual sector study that allows clients to identify lucrative potential business opportunities in the increasingly dynamic international military UAS market. It contains a wealth of timely intelligence and analysis on the systems, as well as requirements on a country-by-country basis.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591