01 October 2018

Government Intervention in U.S. Solid Rocket Motor Market Would Not Address Overcapacity and Likely Weaken the Industry

There has been some growing concern within the U.S. Congress and Department of Defense (DoD) in recent years about the shrinking U.S. industrial base for solid rocket motors (SRM). During the past two decades, the number of American SRM manufacturers has gone from six companies to two companies—Aerojet Rocketdyne of Sacramento, CA and Northrop Grumman Innovation Systems (formerly Orbital ATK) of Dulles, VA.

In October 2017, the U.S. Government Accountability Office (GAO) published a report to Congress titled Solid Rocket Motors: DOD and Industry Are Addressing Challenges to Minimize Supply Concerns. The report highlighted the trend toward greater consolidation of the domestic SRM industry and the efforts being made by DoD to "identify and mitigate" the risks associated with this trend, particularly within the missiles market, including DoD missile systems such as the Advanced Medium Range Air-to-Air Missile (AMRAAM), AIM-9X and Guided Multiple Launch Rocket System.1 The GAO did not offer any recommendations.

On March 1, 2018, DoD submitted its Annual Industrial Capabilities report to Congress for fiscal year 2017. That report noted the possibility that Northrop Grumman could eventually be the sole U.S. manufacturer of large SRMs for strategic missiles and space launch vehicles. This, in turn, has raised some concerns within Congress about whether having only one producer of large SRMs would place at risk the U.S. launch industry's ability to provide “assured access to space” for U.S. national security payloads (satellites) whenever they are needed. It has also created concerns that forcing U.S. government customer such as DoD and NASA to buy from two SRM suppliers to create artificial demand interferes with the workings of the free market and could have the effect of driving up costs and weakening supply chains, rather than strengthening them.

Assured Access is About Reliable Backup Launch Capacity

This concept of assured access to space has been a cornerstone of U.S. space launch policy since it was legislated by Congress in the 1980s. It calls for ensuring the availability of at least two launch vehicles or launch vehicle families—the idea being to always have a backup rocket in the event one of the rockets develops technical problems or experiences a launch failure.

Since the 1990s, assured access to space has been provided largely by Boeing with its Delta IV family of launch vehicles and Lockheed Martin with its Atlas V family. In 2006, the two companies formed a joint venture called United Launch Alliance (ULA), eliminating competition for launching U.S. national security payloads but maintaining the two separate launch vehicle programs. In 2015, the U.S. Air Force certified SpaceX of Hawthorne, CA to launch national security payloads on its Falcon 9 rocket. Since then, DoD has had three options for launching national security payloads—Atlas V, Delta IV and Falcon 9. The policy of assured access to space has never been more assured.

There may be some reasonable concerns about the continued consolidation of the SRM industry in the U.S., but the weakening of assured access to space should not be one of them. The policy is based on having at least two different launch vehicles at the ready, not necessarily two that rely on SRM technology. While the Atlas V and Delta IV programs employ SRM strap-on boosters for some of their variants, both of these programs are in the process of being phased out.

Atlas V will be replaced by a new rocket called Vulcan, which is planned to be launched for the first time in 2020. Vulcan will employ up to six SRM strap-on GEM 63XL boosters produced by Northrop Grumman Innovation Systems. Atlas rockets, meanwhile, will keep flying for a few years after that until Vulcan is fully ready take over. The last Delta IV-Medium rocket is scheduled to be launched in 2019, while the last Delta IV-Heavy is scheduled for launch in 2023.

During the upcoming phase out period for these two legacy launch programs (Altas V and Delta IV), the Falcon 9 will continue to be available. Falcon 9 carries no SRMs. Each Falcon 9 employs nine Merlin 1D rocket engines on its first stage and one Merlin 1D on its second stage. SpaceX-produced Merlin 1D engines use liquid fuel, specifically liquid oxygen (LOX) and a highly refined form of kerosene known as RP-1. The new Falcon Heavy, first launched on February 6, 2018, is also powered solely by Merlin 1D liquid-fuel engines.

The all-liquid-fueled heavy-lift New Glenn family of launch vehicles, under development by Blue Origin of Kent, WA, should be operational early in the next decade. New Glenn rockets will be powered by seven Blue Origin-produced BE-4 engines on the first stage, two BE-3U engines on the second stage, and one BE-3U engine on the third stage. The BE-4 engines use methane/LOX fuel and BE-3Us use a mix of liquid hydrogen (H2) and LOX. First launch of a New Glenn is scheduled for 2020-2021. Additionally, Space X is developing a super heavy-lift rocket called the Big Falcon Rocket (BFR), which will use only methane/LOX fuel for each of its two stages. The BFR is scheduled for a first launch by 2020.

In short, the current abundance of launch capacity available for U.S. national security payloads will continue for the foreseeable future and, if anything, will increase. Some of the launch vehicles will be powered entirely by liquid-fuel rocket engines and some will be powered by a mix of liquid-fuel engines and SRMs. From the standpoint of fulfilling the policy of assured access to space, what is important is the availability of reliable backup launch capacity. Whether this is achieved with rockets that use liquid-fuel rocket engines or SRMs or some mix of the two is not especially relevant to the policy.

However, even if there were to arise an increased need for more SRM-powered launch vehicles, the reality is that there currently exists significant excess production capacity in the U.S. for large SRMs—as opposed to the smaller SRMs used on tactical missiles. This overcapacity has existed for many years, but it became most evident following the phase out of the Space Shuttle program a decade ago. Each Space Shuttle launch system carried two SRM strap-on boosters. According to a 2010 Pentagon report titled “SRM Industrial Base Interim Sustainment Plan to Congress,” the Shuttle program accounted for 70 percent of U.S. demand for large SRMs.

The SRM overcapacity problem seemed destined to become worse in early 2010 when the Obama administration cancelled NASA’s Constellation program, which sought to develop a follow-on launch system to the Shuttle. Constellation would have resulted in the Ares I rocket, whose first stage was designed to be SRM-powered, and the larger Ares V, which would have carried two SRM strap-on boosters.

According to a Space News article from July 28, 2010 quoting from the Pentagon’s report: “The Department cannot sustain the significant overcapacity that has developed in the industrial base. Sustaining overcapacity is not cost-effective for the Department or the American taxpayers, nor is it a realistic or acceptable business model for the large-SRM prime contractors.”

That excerpt gets to the heart of why it is bad policy for the U.S. government to intervene in the SRM industry and attempt to artificially sustain two SRM manufacturers as a way to reduce risk and save money. Such a policy would actually have the opposite effect by making the overcapacity situation more acute, thus weakening both Aerojet Rocketdyne and Northrop Grumman Innovation Systems and endangering the financial viability of both companies.

It is worth noting that demand for large SRMs for U.S. launch vehicles in the near-term is, at best, stagnant. Besides Lockheed Martin’s planned Vulcan rocket, the only other major U.S. launch vehicles that would employ SRMs are NASA’s Space Launch System (SLS) and Northrop Grumman Innovation Systems’ recently-proposed OmegA rocket.

Plans call for the first OmegA to be launched in 2021. The rockets would consist of two solid-fueled (hydroxyl terminated polybutadiene or “HTPB”) stages and as many as six strap-on boosters manufactured by Northrop Grumman Innovation Systems plus a liquid fueled (H2/LOX) third stage powered by two RL-10C-5-1 engines built by Aerojet Rocketdyne. OmegA is being developed to compete for launching intermediate- and heavy-sized Air Force national security satellites.2

SLS, which has been under development for about seven years now, is scheduled for a first launch in 2019-2020. SLS is, essentially, a revived and renamed Constellation program. The rocket would consist of two liquid-fueled (H2/LOX) stages plus two SRM strap-on boosters supplied by Northrop Grumman Innovation Systems. There are not many missions for SLS and so its operational costs have been estimated as high as $2.5 billion per launch, likely making it a non-viable launch vehicle. Were SLS to be cancelled, the SRM overcapacity problem would grow even worse, in which case sustaining two manufacturers of large SRMs, particularly if was done artificially by the U.S. government, would make even less sense.

The Space Launch Market Has Changed

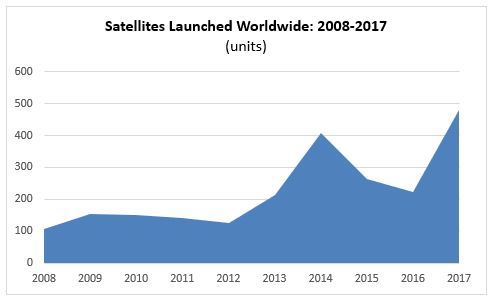

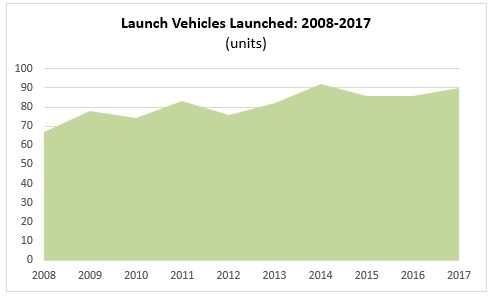

The main reason assured access to space for U.S. national security payloads does not represent the challenge that it was 20-30 years is that the launch market, overall, has started to change in the last 10 years, and particularly so in the last few years. The market is much more robust and more diverse. There are many more satellite operators, satellite manufacturers, and users of satellite services worldwide.

More satellites (and more types of satellites) are being built and proposed to be built and launched in the future than at any time since the launch of Russia’s Sputnik 1 satellite in 1957. There is much more volume of business in the satellite market than there was 20-30 years ago, and so there is considerably more demand for rockets to launch satellites into orbit.

The advent of the so-called “NewSpace” satellite and launch services entrepreneurial companies in recent years strongly suggests that the space market, in general, is about to be transformed as it enters a new phase of growth that will be much more robust than even in the past few years. These companies are proposing to build thousands of new commercial satellites as part of large constellations such the 11,943-satellite Starlink, the 1,980-satellite OneWeb and the 500-satellite EarthNow that would provide low-cost Internet access and other broadband communications worldwide, along with advanced, near real-time imaging of the entire Earth.

This emerging NewSpace satellite market is helping to fuel the development of dozens of new rockets, of varied sizes and configurations, to provide the needed launch capacity within the next 5-10 years—heavy-lift rockets such as BFR, Falcon Heavy and New Glenn, as well as smaller ones such as Alpha, Electron, LauncherOne and Vector-R. Almost all of these new launch vehicles are being developed by private entrepreneurial American companies that are aware of the dramatically changing nature of the space launch market and its new seemingly unlimited potential.

SpaceX has been particularly successful with its Falcon 9 at quickly positioning itself as a leader within the launch services market by offering a rocket that is both reliable and considerably less expensive than its more established competitors. The low price offered by the company for its vehicle was achieved through cost savings it realized through its manufacturing and assembly processes. Essentially, SpaceX developed the capability to build its rockets in-house, minimizing the amount of work it had to contract out, and the company learned that assembling its rockets horizontally rather than vertically saved time and money.

Furthermore, SpaceX has aggressively marketed its product to every segment of the launch market—civil, commercial, military and university/non-profit—enabling it to accumulate perhaps the most extensive launch manifest of any other launch provider in the world. The company’s growing and expansive backlog of payloads and increasing frequency of launches has allowed it to keep its launch prices low.

In 2017, SpaceX successfully launched 18 Falcon 9 missions. That was more than any rocket has launched in one year in at least the last two decades. SpaceX plans to increase its launch “cadence” this year by 50 percent. By continually increasing its launch volume, SpaceX will be able to further lower its launch prices, but another cost cutting factor will be the company’s successful efforts to develop fly-back reusable launch vehicle technology. Already, the company is regularly reusing the first stages of its rockets and saving money and time by not having to build entirely new rockets for each mission.

The ability of SpaceX to provide reliable and relatively inexpensive launch services illustrates the point that competition isn’t the sole, or even the most important, consideration in offering, containing and reducing low launch prices. I offer this point in response to congressional concerns about the impact that further consolidation of the U.S. industrial base for large SRMs might have on pricing.

Conclusion

Attempting to create an artificial competitive environment between Aerojet Rocketdyne and Northrop Grumman Innovation Systems with regard to large SRMs and weapon systems for launch vehicles would be destined to fail. In order for competition to work and do things like lower prices, it has to be based on real market conditions, actual demand for products and services.

The prevailing condition of the U.S. market for large SRMs is overcapacity. Forcing government agencies through legislation to acquire large SRMs from multiple sources only creates the illusion of a robust domestic industrial base while ignoring the realities of the commercial and government markets. What would come next, requiring NASA, the Pentagon and others to dual-source small SRMs as well?

While such proposals may appear as reasonable methods to stimulate declining demand for U.S. SRMs, it would likely have the unintended consequence of weakening both Aerojet Rocketdyne and Northrop Grumman Innovation Systems, as well as their supply chains, while driving up costs and increasing risk.

If Congress, DoD and NASA want to keep the U.S. SRM industrial base alive and well, it should do so through fair and open competition.

Endnotes

1 United States Government Accountability Office. Solid Rocket Motors: DoD and Industry Are Addressing Challenges to Minimize Supply Concerns. GAO October 2017.

2 Malik T. Meet OmegA: Orbital ATK Unveils Name, Upper Stage Pick for Next-Gen Rocket. Space.com Apr. 17, 2018.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591