28 January 2025

Civil UAS Sector Study RELEASED

The content presented below is taken form Teal Group's

2024/2025 World Civil Unmanned Aerial Systems Market Profile & Forecast

No longer a novelty, uncrewed aerial systems have become increasingly common sights in skies around the world as more industries find uses for them, governments reshape regulations, and companies deliver increasingly advanced technologies and services. Civil government and commercial drone markets continue growing, moving from nascence to adolescence, as UAS prove their worth in numerous fields. For the moment, though, sales growth in several sectors appears to be moving from new customers to replacement for previous systems.

There are signs of moderation in the market. In just the last year, the number of UAS registered in the United States dropped by 8%, even as the number of certificated operators increased 25%. (Of the 791,597 drones registered in the US, 396,746 are for commercial use and 387,746 recreational, roughly a 50/50 split. However, that marks a significant change from the 59/41 split only a year ago, with the number of recreational drones falling significantly.) 415,635 remote pilots were certified as of October 2024.

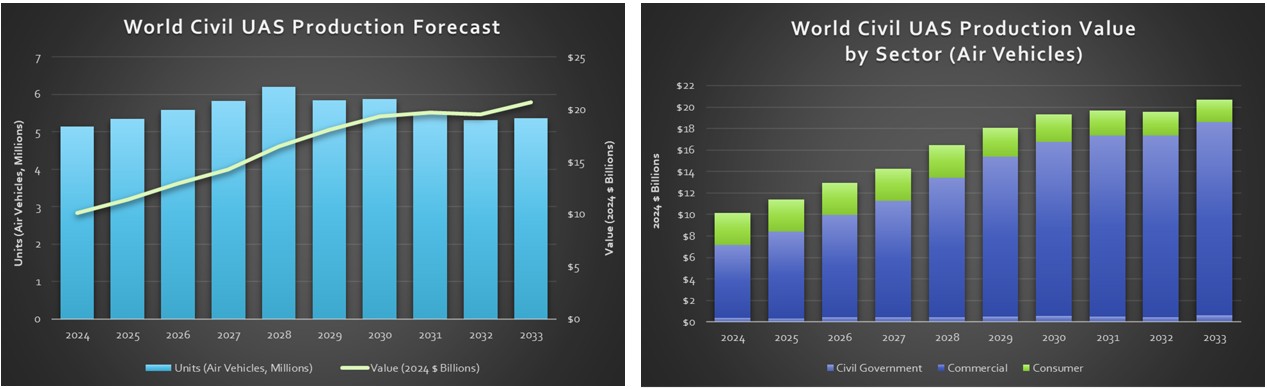

The market for civil UAS will continue to be one of the most dynamic aerospace growth sectors through the beginning of the next decade, emerging from a $10.1 billion market (value of air vehicles) in 2024 to climb to $20.6 billion by 2033. That represents a 6.8% compound annual growth rate (CAGR) in constant dollars. Over the next 10 years the market will total $162.3 billion. However, that CAGR is down from previous forecasts, consistent with our projection that most sectors reach peak expansion around 2028, as companies come to understand their requirements for UAS, the technology matures, and regulation stabilizes.

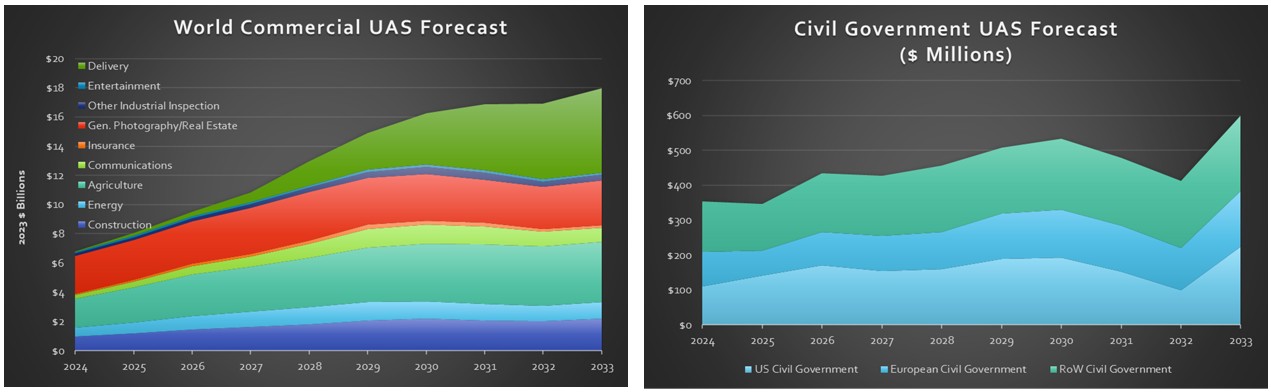

Although the consumer systems and commercial systems segments began the forecast period in our 2020 study relatively close in annual production value of air vehicles at 42% and 55% respectively, they have diverged as the latter segment took off. By the end of our current 10-year forecast, commercial systems will command 87% of the overall civil UAS market by value, while consumer systems will slip to 10%, with the remainder being government systems.

After years of delays, civil governments in the United States and Europe have gotten serious about deploying UAS. Civil government drone spending promises to continue benefiting from concerns about border and maritime security in the United States and Europe. In addition, public safety use for law enforcement and fire control is growing, with new companies considering and/or entering the field, and existing firms offering UAS tailored to these sectors’ specific requirements.

The US federal government stands to be a market maker for “Blue UAS,” systems certified as secure and suitable replacements for Chinese-made drones that are being eliminated from federal agency fleets. The Department of Defense has certified 25 systems to carry this designation as of May 2024. Industry has followed, with the Association for Uncrewed Vehicle Systems International (AUVSI), the leading UAS trade association, unveiling a “Green UAS” certification for commercial systems meeting standards of corporate cyber hygiene, product and device security, and supply chain risk management.

World Civil Unmanned Aerial Systems Market Profile & Forecast is an annual sector study that allows clients to identify lucrative potential business opportunities in the increasingly dynamic international military UAS market. It contains a wealth of timely intelligence and analysis on the systems, as well as requirements on a country-by-country basis.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591