05 June 2017

Civil UAS Market Forecasted to Grow Dramatically

Teal Group's most recent UAS sector study, World Civil Unmanned Aerial Systems Market Profile & Forecast 2017, reports on numerous key findings, including:

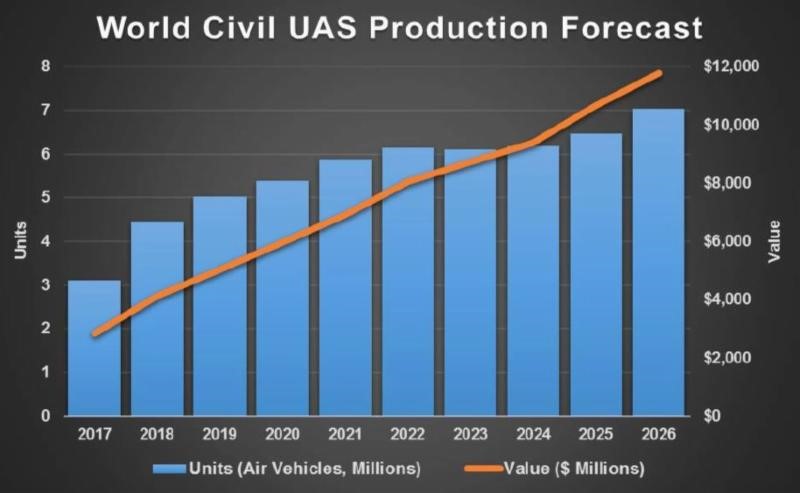

In terms of aerospace, the market for civil UAS promises to be one of the most dynamic growth sectors for the next decade, expanding from a $2.8 billion market in 2017 to more than quadruple to $11.8 billion by 2026. Over the next ten years the market totals almost $74 billion.

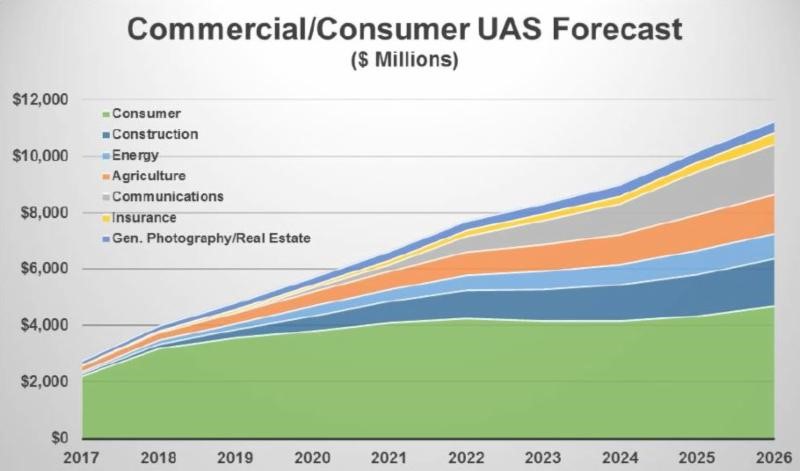

In terms of aerospace, the market for civil UAS promises to be one of the most dynamic growth sectors for the next decade, expanding from a $2.8 billion market in 2017 to more than quadruple to $11.8 billion by 2026. Over the next ten years the market totals almost $74 billion.- Although consumer systems represent about half of the overall market through the decade, the fastest growth comes from commercial systems, which surpass consumer systems in 2024 and continue to widen the lead throughout the rest of the forecast period.

- The commercial segment of the worldwide market will lead growth in civil UAS. Eased airspace regulations, an influx of venture capital investment, the development of a service industry and involvement of major technology companies all are creating the foundations for solid growth. Worldwide commercial is projected to grow from $512 million in 2017 to $6.5 billion in 2026, a 28% compound annual growth rate.

- Virtually all major technology companies are examining their own strategies in the market involving acquisitions and investment. Intel and Facebook made acquisitions of UAS companies and are developing platforms. Verizon, AT&T, Qualcomm and Microsoft are working to enable the drone infrastructure. The study includes detailed analyses of the way strategies are changing.

- The rapid change in the market and the need to generate revenue is forcing technology start-ups to radically change their strategies to offer more complete turnkey, end-to-end solutions. The study examines the flow of venture capital funding to the industry and its impact.

Construction will lead the commercial market. All 10 of the largest worldwide construction firms are deploying or experimenting with systems and will be able to quickly deploy fleets worldwide. The three largest construction equipment suppliers are all either distributing drones or planning to build them by investing in companies and developing systems.

Construction will lead the commercial market. All 10 of the largest worldwide construction firms are deploying or experimenting with systems and will be able to quickly deploy fleets worldwide. The three largest construction equipment suppliers are all either distributing drones or planning to build them by investing in companies and developing systems.- Agriculture, which will adopt UAS more slowly, will still rank second worldwide. The ability to do unmanned spraying of crops and also do imagery that can detect when and where to apply fertilizer, pesticides and water offers tremendous potential. While it grows more slowly than construction, the agricultural UAS market has the potential to continue to grow considerably beyond the forecast period.

- Low-cost, high-altitude, long endurance UAS for internet promises to create an entirely new segment of the market. Airbus has already begun low rate production of solar-powered UAS, and Facebook and others are also working on systems. The technology looks likely to be in place within several years to bring the internet to areas of the world with no service.

- Other important segments, ranked in order by ten-year size, include energy, general photography such as real estate marketing, and insurance. There may be niche applications for delivery UAS during the forecast period such as deliveries of humanitarian supplies to remote developing areas. Yet regulatory restrictions and the uncertain economics of delivery make it impossible to make a forecast for what could potentially be quite a large segment.

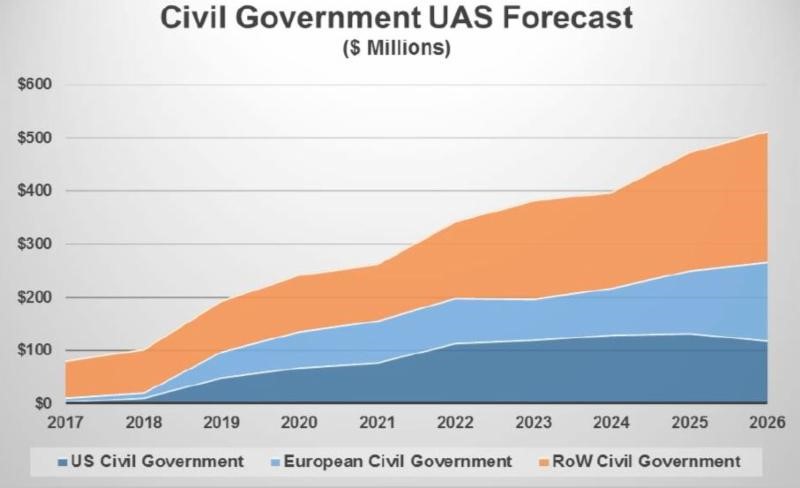

Civil government UAS will be a much smaller segment than commercial, but the appeal is growing. The European Union's Maritime Safety Agency has begun the use of civil UAS by European agencies. The United Nations is seeking to expand the use of UAS in peacekeeping. Drones are catching on with public safety agencies worldwide, particularly in developing countries.

Civil government UAS will be a much smaller segment than commercial, but the appeal is growing. The European Union's Maritime Safety Agency has begun the use of civil UAS by European agencies. The United Nations is seeking to expand the use of UAS in peacekeeping. Drones are catching on with public safety agencies worldwide, particularly in developing countries.- The consumer drone segment will continue to grow although the explosive increase of the recent past will slow. The continuing increase will be based on easier to use systems with new capabilities and a broader range of suppliers.

- Posted in: News Briefs

3900 University Drive, Suite 220

Fairfax, Virginia 22030

Send Email Message

Toll Free: (888) 994-TEAL (8325)

Tel: (703) 385-1992

Fax: (703) 691-9591